Why Your Business Requirements a 2D Payment Gateway for Seamless Purchases

Why Your Business Requirements a 2D Payment Gateway for Seamless Purchases

Blog Article

An In-Depth Consider the Capability and Advantages of Implementing a Payment Entrance

The implementation of a settlement entrance represents a vital development in the realm of digital purchases, supplying services not only enhanced security but additionally a much more efficient processing system. By integrating features such as multi-payment assistance and real-time deal capabilities, companies can substantially enhance customer satisfaction while decreasing the danger of cart abandonment.

Recognizing Repayment Gateways

The significance of modern shopping hinges on the smooth assimilation of payment portals, which act as the vital avenues in between vendors and consumers. A repayment entrance is a modern technology that helps with the transfer of details in between a repayment portal (such as an internet site or mobile app) and the financial institution. This system guarantees that delicate data, consisting of bank card details, is firmly transmitted, hence maintaining the stability of the purchase.

Payment entrances are essential for processing on-line payments, allowing consumers to complete purchases successfully while providing vendors with an automated remedy for managing monetary deals. They sustain various payment techniques, consisting of charge card, debit cards, and different settlement options, satisfying diverse consumer choices.

In addition, payment gateways boost the overall shopping experience by using attributes such as real-time purchase handling and fraudulence discovery mechanisms. They are frequently developed to integrate effortlessly with existing shopping systems, making certain a smooth customer experience. By leveraging these technologies, businesses can expand their reach, increase sales, and foster customer trust. Understanding the functionality of payment gateways is essential for any organization looking to thrive in the competitive landscape of online retail.

Secret Features of Payment Portals

A detailed understanding of repayment gateways additionally includes acknowledging their key attributes, which substantially enhance both functionality and customer experience. One of the foremost attributes is transaction handling rate, which allows sellers to total sales quickly, therefore minimizing cart desertion rates. Furthermore, settlement gateways facilitate a wide variety of payment approaches, including bank card, debit cards, and electronic budgets, accommodating a diverse consumer base.

One more essential function is the straightforward interface, which streamlines the payment process for customers, making it available and user-friendly. This ease of use is enhanced by robust combination capacities, enabling seamless link with numerous e-commerce platforms and point-of-sale systems. In addition, many repayment portals offer adjustable check out experiences, permitting businesses to line up the repayment procedure with their branding.

Real-time reporting and analytics are also essential features, giving sellers with insights into purchase patterns and customer behavior, which can educate service techniques. Lastly, scalability is an essential particular, enabling payment portals to expand alongside a business, suiting boosted deal quantities without jeopardizing performance. On the whole, these crucial attributes highlight the significance of picking a payment portal that aligns with service demands and improves the total customer experience

Safety Measures in Repayment Handling

Ensuring safety in settlement processing is vital for both sellers and consumers, as it safeguards delicate financial info versus fraudulence and cyber threats. Repayment entrances use multifaceted safety and security procedures to develop a durable framework for protected deals. Among the leading approaches is file encryption, which converts delicate data right into a coded format that is unreadable to unapproved customers. This guarantees that info such as charge card numbers and individual information continue to be personal throughout transmission.

Furthermore, payment gateways make use of Secure Outlet Layer (SSL) modern technology to develop protected connections, further protecting information traded between the merchant and the customer. Tokenization is one more vital step; it replaces delicate card info with a distinct identifier or token, reducing the threat of information breaches.

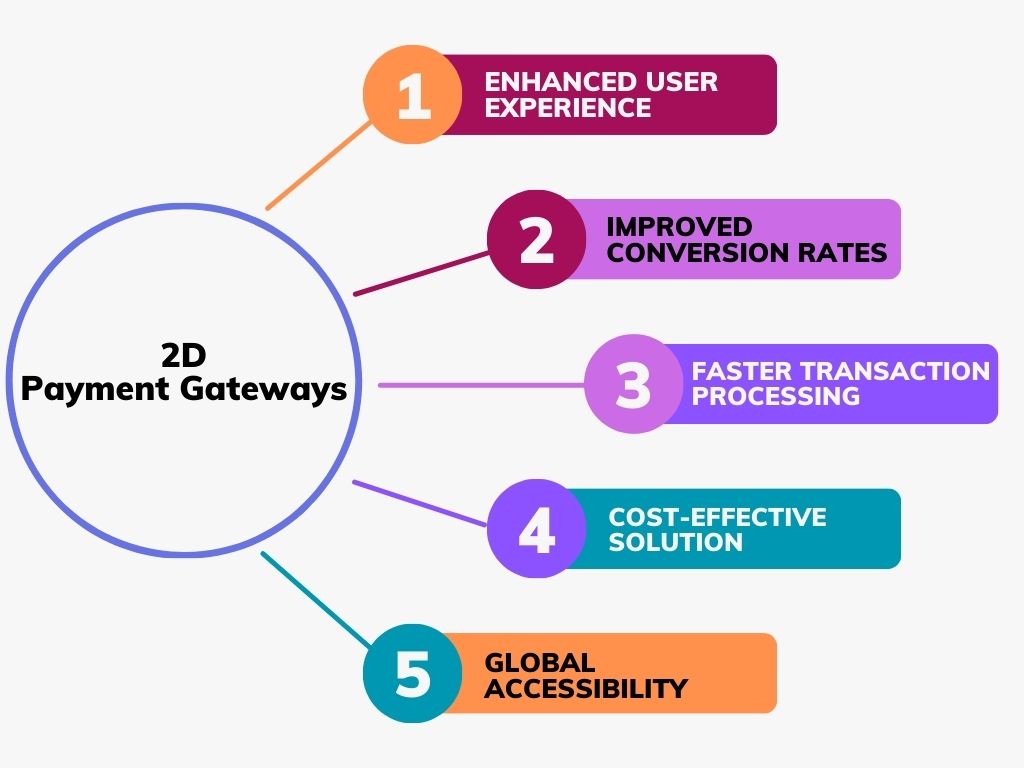

Benefits for Organizations

Organizations can greatly take advantage of the integration of payment gateways, which improve the transaction process and enhance operational efficiency. One of the primary advantages is the automation of settlement handling, lowering the demand for hand-operated treatment and lessening human error. This automation allows my website businesses to focus on core tasks instead of management tasks, eventually improving productivity.

In addition, settlement entrances assist in various payment approaches, consisting of debt cards, electronic purses, and bank transfers. This adaptability caters to a more comprehensive consumer base and urges greater conversion rates, as customers can pick their favored payment method. In addition, settlement gateways frequently provide thorough reporting and analytics, enabling services to track sales trends and consumer habits, which can inform calculated decision-making.

Payment gateways enhance security steps, safeguarding sensitive financial information and lowering the threat of scams. Generally, incorporating a repayment gateway is a strategic move that can lead to raised growth, performance, and earnings opportunities for businesses.

Enhancing Consumer Experience

How can payment gateways boost the consumer experience? By enhancing the repayment process, settlement portals substantially improve the overall shopping trip.

Additionally, repayment gateways sustain several payment approaches, consisting of bank card, electronic budgets, and financial institution transfers, accommodating varied customer preferences. This adaptability not only meets the demands of a larger audience however also cultivates a sense of trust and fulfillment among customers.

Furthermore, a secure settlement environment is extremely important. Repayment portals utilize innovative file encryption technologies, guaranteeing customers that their sensitive details is safeguarded. This degree of safety and security constructs confidence, motivating repeat business and client commitment.

Additionally, several payment entrances offer real-time deal updates, permitting customers to track their repayments instantly. This openness boosts communication and minimizes unpredictability, contributing to a positive client experience. On the whole, by executing a protected and effective settlement gateway, companies can substantially boost customer complete satisfaction and commitment, inevitably driving development and success in an open market.

Conclusion

In recap, the implementation of a repayment gateway provides countless benefits for organizations, consisting of streamlined deal procedures, enhanced protection, browse this site and comprehensive analytics. Eventually, payment entrances offer as important devices for modern-day enterprises intending to grow in a competitive electronic industry.

Additionally, repayment portals facilitate a wide range of settlement approaches, including debt cards, debit cards, and digital budgets, providing to a varied customer base.

Many repayment entrances supply personalized checkout experiences, allowing companies to line up the settlement procedure with their branding.

In addition, settlement gateways facilitate various repayment techniques, including credit score cards, electronic pocketbooks, and financial institution transfers. By streamlining the payment procedure, settlement portals significantly enhance the overall purchasing trip.In addition, many settlement portals supply real-time purchase updates, permitting clients to track their repayments instantaneously.

Report this page